Eligibility

When you turn 65, you become eligible for Parts A and B. Understand enrollment periods and avoid penalties.

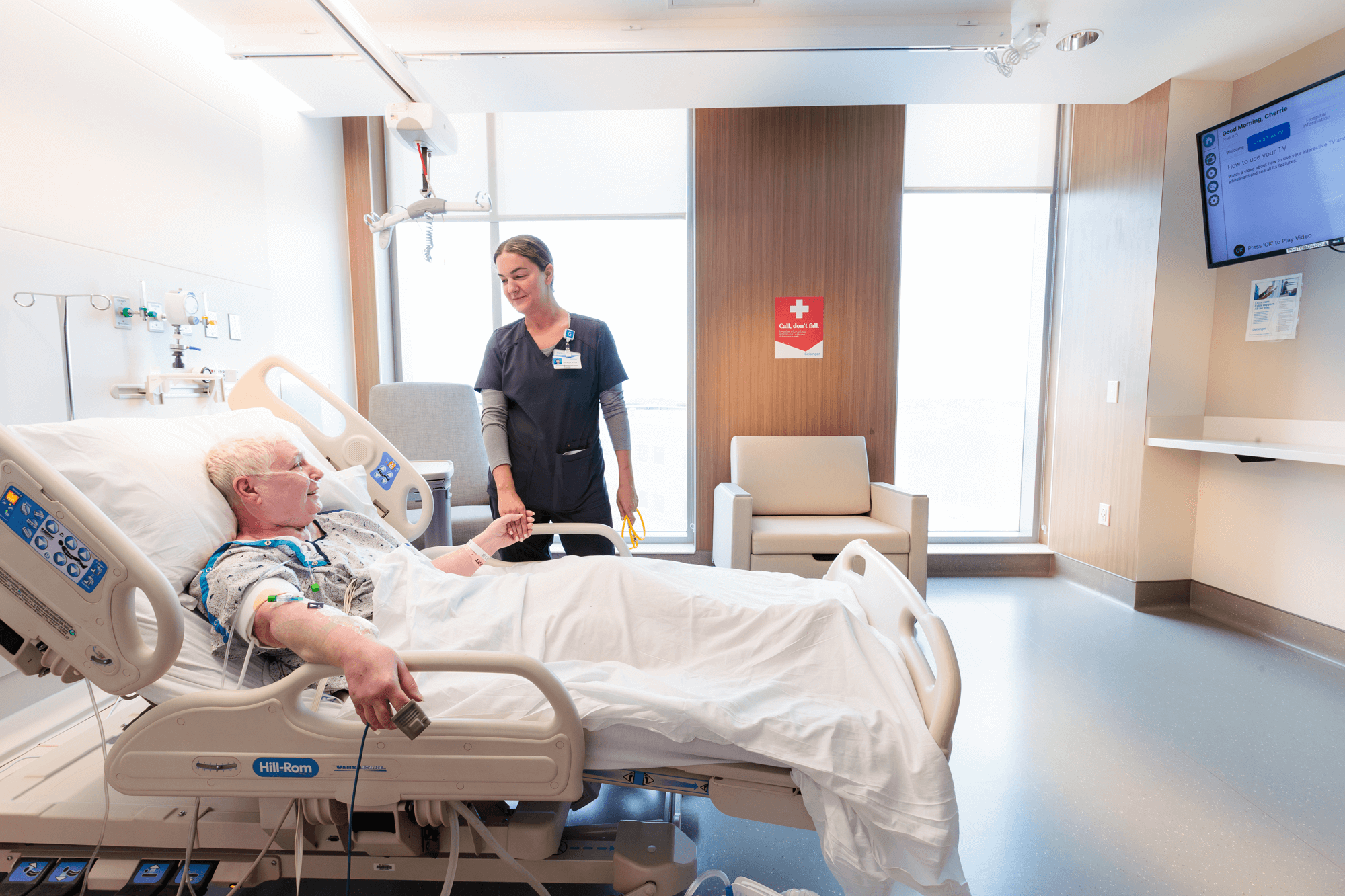

To choose the right plan for your loved one, you need to understand how basic Medicare is different from Medicare Advantage.

Medicare (Original Medicare)

Medicare Advantage (Part C)

When you turn 65, you become eligible for Parts A and B. Understand enrollment periods and avoid penalties.

Know your options for hospital stays, routine care, drug coverage and wellness benefits.

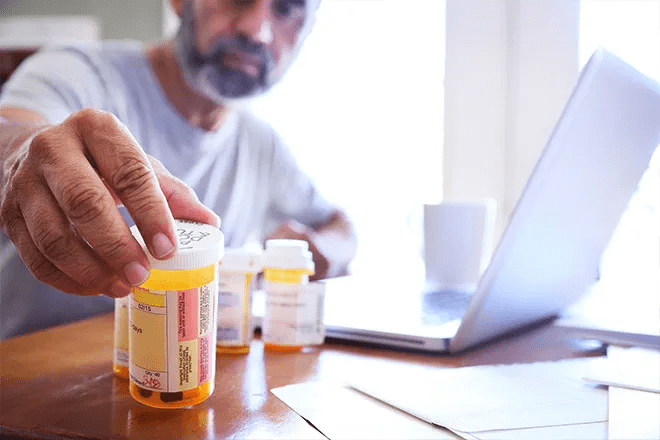

Medicare Part D is your prescription drug coverage, designed to make medications more affordable.

Easily navigate Medicare and Medicare Advantage enrollment with this step-by-step guide.

Does your plan no longer meet your needs? Consider switching during key enrollment periods.

Common questions about Medicare.

Speak 1:1 with an advisor for a no-pressure Q&A about your health coverage options.

Prefer a face-to-face discussion? Come to one of our events and ask your questions in person.

Make life simpler — enjoy the personalized convenience of having an advisor visit you at home.

Geisinger Gold Medicare Advantage HMO, PPO, and HMO D-SNP plans are offered by Geisinger Health Plan/Geisinger Indemnity Insurance Company/Geisinger Quality Options, Inc., health plans with a Medicare contract. Continued enrollment in Geisinger Gold depends on contract renewal. Geisinger Health Plan, Geisinger Indemnity Insurance Company, and Geisinger Quality Options, Inc. are part of Geisinger, an integrated health care delivery and coverage organization. Risant Health is the parent organization of Geisinger.

Y0032_25182_5_M