Questions and answers

We know health insurance can be complicated. Here are answers to the most common questions we hear.

Annual Open Enrollment begins every year on Nov. 1 and continues through Jan. 15. If you enroll between Nov. 1 and Dec. 15, your coverage will start Jan. 1. If you enroll between Dec. 15 and Jan. 15, your coverage will start on Feb. 1.

If you missed Open Enrollment, you may still be able to enroll if you have a Qualifying Life Event (QLE).

Shop for and enroll in a Geisinger Marketplace plan online or contact one of our knowledgeable, friendly representatives at 800-223-1282, Monday through Friday, 8 a.m. to 5 p.m.

Coinsurance is your share of the costs of a covered healthcare service, which is a percent of the allowed amount for the service. You pay coinsurance plus any deductibles you owe. Your insurance plan pays for the rest of the allowed amount.

Under the Affordable Care Act (also known as the ACA, or healthcare reform), the below metallic tiered categories are based on how you and your plan splits your healthcare costs. There are four metallic levels (bronze, silver, gold and platinum).

Geisinger Health Plan offers three metallic levels (bronze, silver and gold.)

- Bronze: Your health plan pays 60% on average. You pay about 40%.

- Silver: Your health plan pays 70% on average. You pay about 30%.

- Gold: Your health plan pays 80% on average. You pay about 20%.

As you go from bronze to gold, the monthly premiums tend to go up. So, a bronze plan would generally have a lower premium than a gold plan.

If your question isn’t answered here, call us at 800-223-1282.

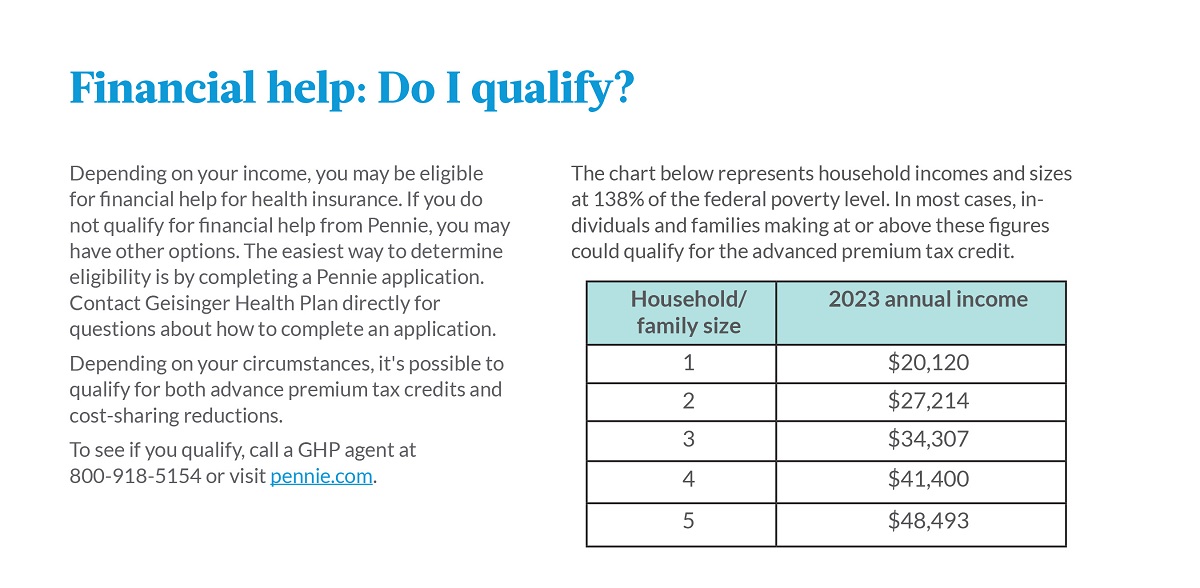

Depending on your income, you may be eligible for financial help for health insurance. If you do not qualify for financial help from Pennie®, you may have other options. The easiest way to determine eligibility is by completing a Pennie application. Contact Geisinger Health Plan directly for questions about how to complete an application.

Depending on your circumstances, it’s possible to qualify for both advance premium tax credits and cost-sharing reductions.

To see if you qualify, call a GHP agent at 800-918-5154 or visit pennie.com.

HMO (health maintenance organization)

With an HMO plan, you select a primary care physician (PCP) who will help manage your health and wellness. HMOs generally cost less because you use in-network providers.

POS (point of service)

With POS, you select a PCP to help coordinate your care. You can see other healthcare providers — in or out of our network. You will pay more for services received from providers outside our network.

PPO (preferred provider organization)

With a PPO, you do not need to select a PCP. You can see other healthcare providers — in or out of our network. You will pay more for services received from providers outside our network.

Geisinger Extra

With our Geisinger Extra plans, if you visit a primary care site designated as a “Geisinger Extra” site, you will pay lower office visit copays. Some Geisinger Extra sites are also ProvenHealth Navigator® locations, where extra care is provided because the office is staffed with a Geisinger Health Plan nurse. Find a Geisinger Extra site near you.

Geisinger Extra plans are only available in the following counties:

- Carbon

- Centre

- Clinton

- Columbia

- Cumberland

- Dauphin

- Juniata

- Lackawanna

- Lehigh

- Luzerne

- Lycoming

- Mifflin

- Monroe

- Montour

- Northampton

- Northumberland

- Perry

- Schuylkill

- Snyder

- Susquehanna

- Union

- Wayne

- Wyoming

QHDHP

A qualified high-deductible health plan (QHDHP) has lower premiums and higher deductibles than a traditional insurance plan. You must have a QHDHP to have a health savings account.